Figure federal withholding

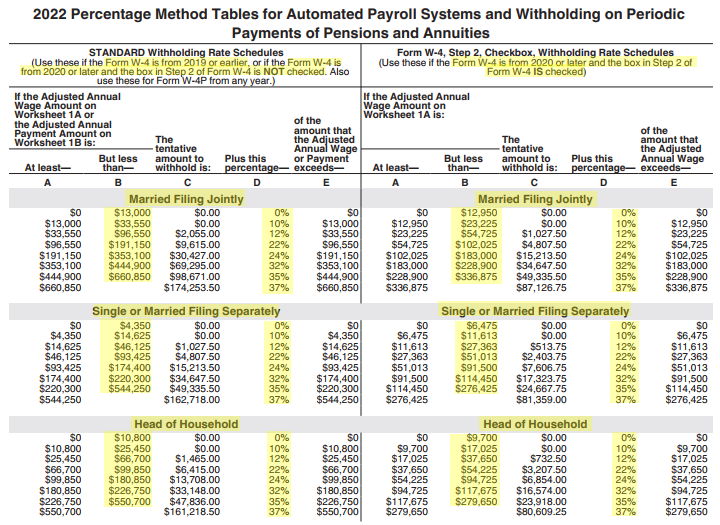

Youll need your most recent pay. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022.

How To Calculate Federal Income Tax 11 Steps With Pictures

Five to 10 minutes to complete all the.

. 10 12 22 24 32 35 and 37. If youre exempt from withholding meaning you didnt pay any federal income taxes last year and dont expect to owe any this year you can choose not to have any federal. Withholding allowances were exemptions that employees used to use to claim from federal income tax using Form W-4.

Added to your income tax liability is the. Withholding allowances were used to determine an. For employees withholding is the amount of federal income tax withheld from your paycheck.

Use the Tax Withholding Estimator on IRSgov. The federal withholding tax rate an employee owes depends on their income. Lets call this the refund based adjust amount.

Complete a new Form W-4P Withholding Certificate for Pension or. How to Check Your Withholding Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. The federal withholding tax has seven rates for 2021.

Use an employees Form W-4 information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 15 Employers Tax Guide and Pub.

Net earnings are your gross business earnings minus trade and business expenses. 250 and subtract the refund adjust amount from that. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer.

IR-2019-155 September 13 2019 WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov includes user-friendly features designed to help. It describes how to figure withholding using the Wage. Be sure that your employee has given you a completed.

Plan to pay taxes on 9235 of your net earnings. Then look at your last paychecks tax withholding amount eg. 51 Agricultural Employers Tax Guide.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Figure out which withholdings work best for you with our W-4 tax withholding calculator. This publication supplements Pub.

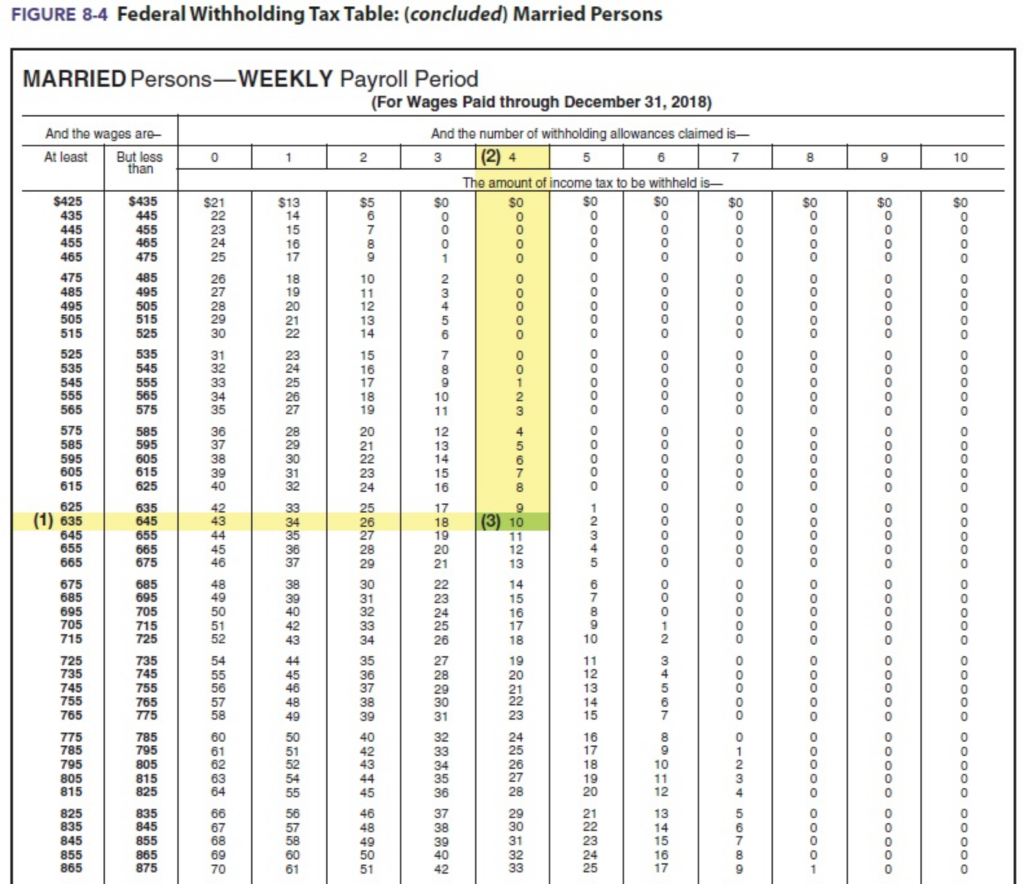

Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax FIT. Your W-4 calculator checklist. 250 minus 200 50.

The amount of income tax your employer withholds from your regular pay.

Income Tax Formula Excel University

How To Calculate Federal Income Tax

How To Calculate 2018 Federal Income Withhold Manually

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

Computing Federal Income Tax Using The Table Chegg Com

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Powerchurch Software Church Management Software For Today S Growing Churches

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Federal Withholding Tax Youtube

Calculating Federal Income Tax Withholding Youtube

Calculation Of Federal Employment Taxes Payroll Services

Excel Formula Income Tax Bracket Calculation Exceljet